Ditch the D-Word, Dodge the O-Word, and Embrace Lifestyle

Here’s a case study for the ages. In the midst of our relentless obesity epidemic, consumers have made a massive shift in attitudes about weight and health. Suddenly, weight management brands found themselves at risk. The biggest brand – Weight Watchers – faced the greatest risk. And now it seems to be emerging in a new, stronger position. Weight Watchers has ditched the D-Word (dieting). It’s dodging the O-word (obesity), and embracing a new identity. Slowly, but surely, Weight Watchers is becoming a lifestyle brand.

Ditching the D-Word

If you think back to 1982, when Diet Coke debuted, you can see how far the D-word has fallen. Back then, Diet Coke was an instant sensation. Overnight, it became the largest selling low-calorie soda. Robust growth continued and in 2011, it surpassed even Pepsi to become the second-biggest selling soda in the U.S. Only Coke itself was bigger. Obviously, the D-word was not a problem back then.

Today, Diet Coke is falling fast and Coke Zero Sugar is passing it. Diet Pepsi is dropping like a rock. In fact, virtually every brand tied to a diet is fading fast.

This shift hit Weight Watchers like a ton of bricks in 2015. In the critical New Year’s season, subscriptions dropped by 20%. Consumer research painted a dire picture. Weight Watchers was a diet brand and consumers don’t want to diet anymore. In fact, even feelings about watching weight are very mixed.

Weight Watchers responded by relaunching the brand and going “beyond the scale” in late 2015. This was when Oprah Winfrey bought into the brand. Now, preparing for the upcoming new year, the brand is launching a yet more flexible program.

Dodging the O-Word

All this comes while consumers are turning away from concerns about obesity. That O-word has never been popular because of all the stigma attached to it. But today, it’s even less popular.

New Gallup research says that concern about obesity has plunged over the last two years. The number of people who think of themselves as “overweight” is dropping even as their self-reported weight is climbing.

So, now more then ever, you will never find the O-word linked to mainstream consumer brands.

Embracing Lifestyle

What you will find is lots of talk about a healthy lifestyle. Fast Company says that Weight Watchers has transformed itself into a lifestyle brand.

Weight Watchers’ top competitor in this space, Nutrisystem, never had as much baggage from the diet industry. Nutrition and food were always core elements for the brand. By bringing South Beach into the business, Nutrisystem has strengthened its lifestyle position.

Weight Watchers’ top competitor in this space, Nutrisystem, never had as much baggage from the diet industry. Nutrition and food were always core elements for the brand. By bringing South Beach into the business, Nutrisystem has strengthened its lifestyle position.

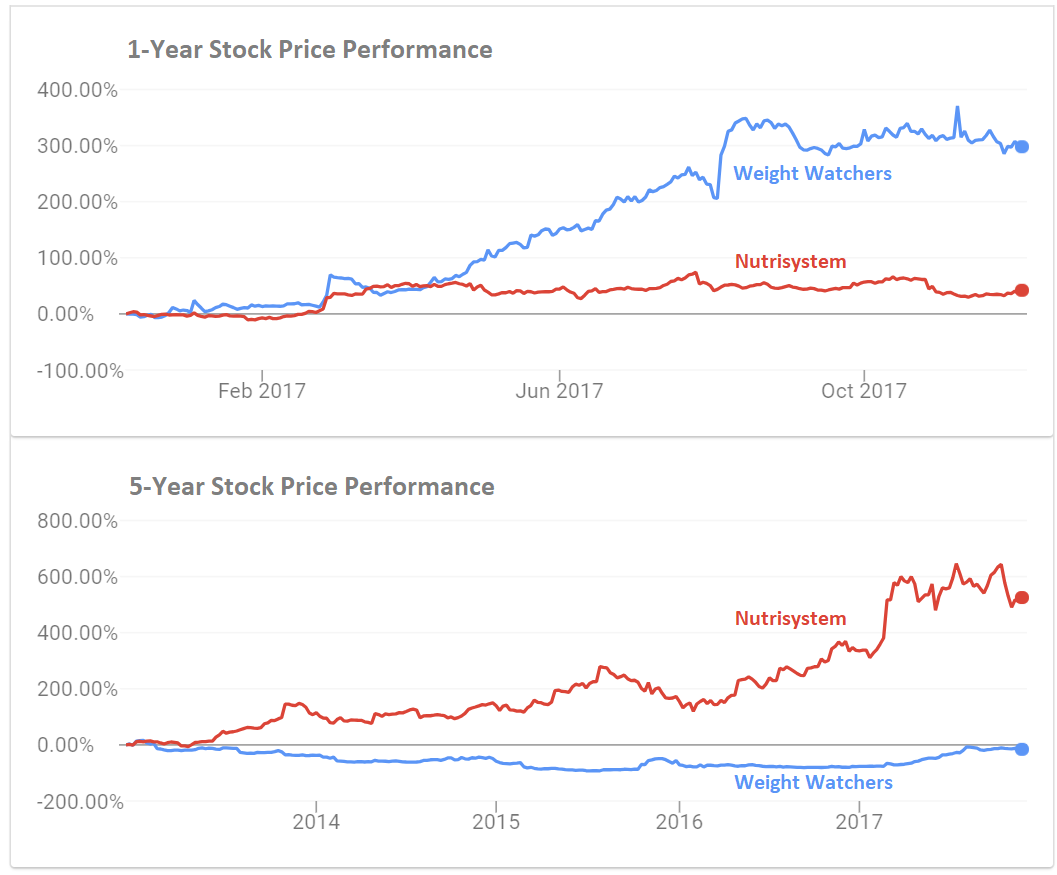

These pressures are evident when you compare stock price trends for Weight Watchers and Nutrsystem. Over the last five years, Weight Watchers has struggled with the stigma of being a diet brand. But if you zoom in on the last year, its recovery is impressive.

No doubt about it. Consumers are fickle. Diets are dead. Healthy living is the aspiration. And for now, most consumers just don’t want to think about obesity.

Click here for more from Fast Company.

Pears, photograph © Geoffrey Coelho / flickr

Subscribe by email to follow the accumulating evidence and observations that shape our view of health, obesity, and policy.

December 7, 2017