Waiting for Godot and for SSB Taxes to Work

In the realm of obesity and public health, the role of sugar-sweetened drinks in obesity is an article of faith. Questioning it will get you a tongue-lashing at best, but more likely, shunned. Likewise, the cool kids in public health expect you to agree that SSB taxes work. Yet again, we have a new study of the effect of a tax on SSB consumption. This one, by Sara Bleich and colleagues, appeared recently in JAMA Network Open. No surprise here. It shows that when taxes make SSBs more expensive, people buy less of them.

Studies like this have become so redundant that they are hard to count – like the stars in the sky.

But what’s lacking is evidence that this strategy will reduce obesity and have any effect on population health.

“It’s OK to Demonize SSBs”

Former New York City Health Commissioner Mary Bassett explained it to us this week. “Demonizing” SSBs is OK because they offer no nutritional value other than a lot of calories. Taking it a step further, public health pundits have been demonizing sugar generally for some time now. “Sugar is toxic” is the rallying cry that David Lustig made famous. And it’s working. Even without soda taxes or taxes on other sugary foods, consumption of sugar and other caloric sweeteners has been dropping for two decades in the U.S.

Former New York City Health Commissioner Mary Bassett explained it to us this week. “Demonizing” SSBs is OK because they offer no nutritional value other than a lot of calories. Taking it a step further, public health pundits have been demonizing sugar generally for some time now. “Sugar is toxic” is the rallying cry that David Lustig made famous. And it’s working. Even without soda taxes or taxes on other sugary foods, consumption of sugar and other caloric sweeteners has been dropping for two decades in the U.S.

The USDA Economic Research Service published new data earlier this year. It tells us that per capita caloric sweeteners had dropped from a high of 152 pounds in 1999 to 123 pounds in 2019. This new level is similar to the levels last seen in the late 1970s and early 1980s. So it would seem that demonizing sugar is working – even without taxes.

At least it’s working to reduce sugar consumption.

But Does It Make People Healthier?

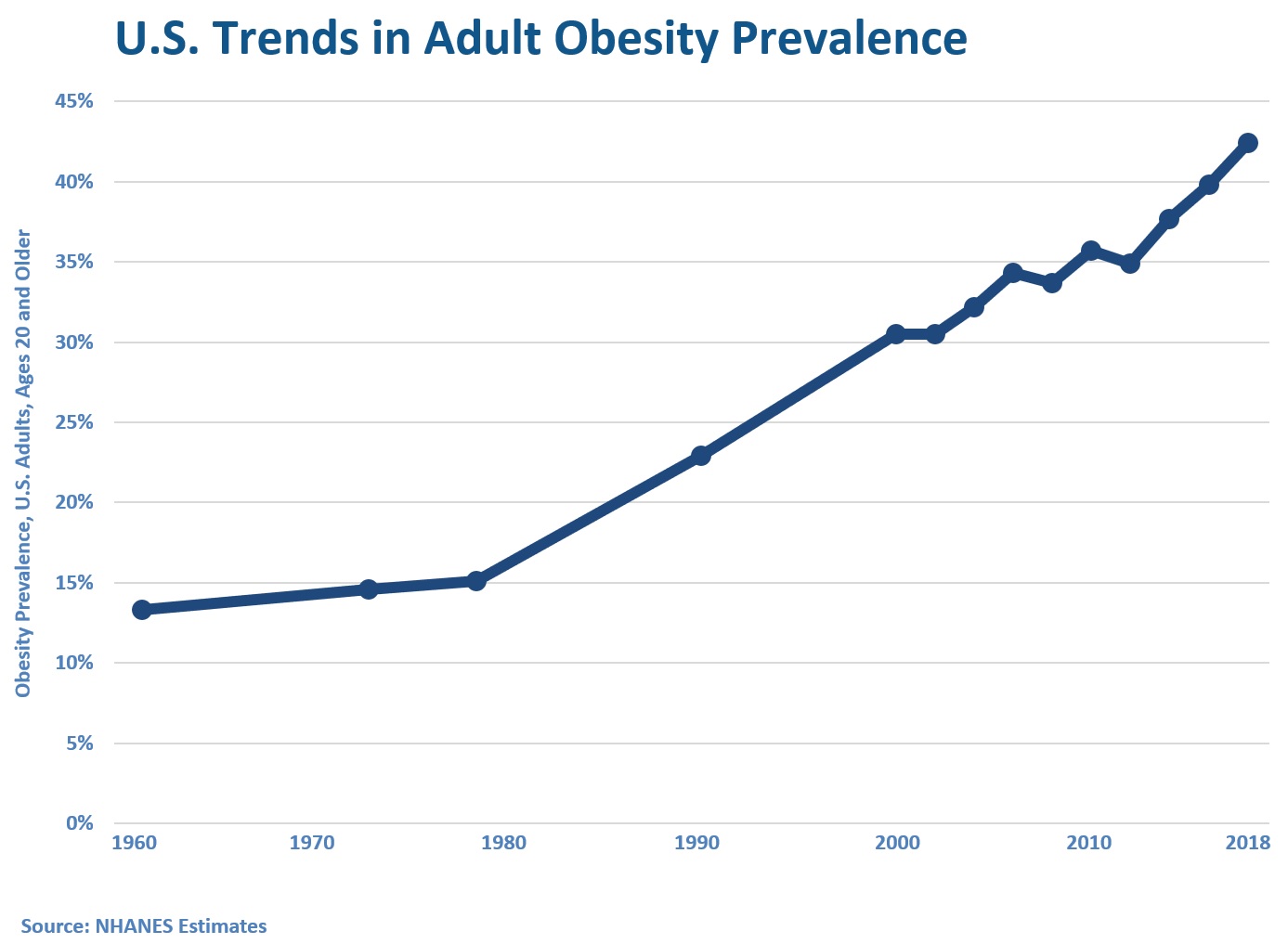

The only trouble with the presumption that demonizing and taxing sugar will reduce obesity is this: it’s only a presumption. Through two decades of sharp declines in sugar consumption, obesity has continued to rise without a pause.

The only trouble with the presumption that demonizing and taxing sugar will reduce obesity is this: it’s only a presumption. Through two decades of sharp declines in sugar consumption, obesity has continued to rise without a pause.

Meanwhile, it is clear that taxes on sugary beverages and foods are regressive. They put the biggest burden on shoppers in low-income neighborhoods, as the Bleich study shows. So we have some doubts about the fairness of taxing poor and disadvantaged communities to make them behave in ways that we deem to be healthier – especially when health benefits are not showing up

Maybe the effect will kick in any day now. After two decades of dropping sugar consumption, it does seem like it’s about time for some relief.

The cool kids in the right circles of public health seem to be comfortable with pushing for more taxes on people who don’t eat like we think they should. But we we’re still waiting for some health benefits to show up and justify it. Perhaps, like Godot, they may never arrive.

Click here for the study by Bleich et al and here for research on the distribution the burden from sweetener taxes.

Waiting for Godot, photograph by Fernand Michaud, licensed under CC0 1.0

Subscribe by email to follow the accumulating evidence and observations that shape our view of health, obesity, and policy.

June 25, 2021

June 25, 2021 at 9:59 am, Allen Browne said:

Data and reason rarely overcome dogma and bias.

June 29, 2021 at 7:22 am, Michael Jones said:

Taxing addiction will not work. Philadelphia’s trial with taxing SSBs (which are indeed horrible for one’s health) did show a drop in SSB consumption, but an increased consumption of other sources of simple carbs/sugars.